Due to Covid-19, online shopping has been one of the most popular digital activities worldwide, accounting for 18% of global retail sales. This statistic is forecasted to reach nearly 22% in 2024. The substantial rise of momentum in eCommerce is likely to continue as shoppers have experienced convenience and discounts. Plus, over 67% of online customers responded that they would not change their current online shopping habits even when Covid vaccinations become available to the public.

However, a recent study showed that one-third of consumers who get vaccinated are eager to participate in in-person shopping, dining out, or attending concerts. So the question is: what will their spending look like in the coming months? Let’s dive into our predictions to see what you could do to make your business fit in future eCommerce retail.

Demands for Fulfillment are Growing

The jump in digital purchasing has led to significant changes for fulfillment centers. The future eCommerce retail will require more warehouse space, an enormous variety of products, and rapid fulfillment. Hence, delivery is now a cornerstone of eCommerce success. Brands should find other ways to optimize fulfillment operations.

Did you know that 65% of consumers check free shipping thresholds before adding an item to their cart? Also, the pandemic is no longer an excuse for service disruptions, particularly once Coronavirus vaccines roll out. In terms of online shipping, 21% of US buyers would not forgive brands for late shipping while 67% of consumers expect same-day, next-day, or two-day delivery.

To meet customer expectations, eCommerce retailers are vying for limited shipping capacities. The combination of complex demands and rising shipping costs create undue pressure on brands. FedEx announced an average 4.9% rate increase in shipping costs. Due to the strain caused by rising costs, they now plan to hike prices during holiday seasons and charge late fees for merchants who miss payments. UPS prioritizes aligning pricing with the values the company provides. Distribution centers are fulfilling smaller DTC orders faster to meet shipping deadlines.

Now, it’s time for businesses to start improving fulfillment productivity, picking, and handling processes. One solution SMBs could consider is a fulfillment option like ‘click and collect.’ A recent survey by Shopify indicated that 40% of consumers chose curbside pickup during the first three months of the pandemic, and about 100,000 brands worldwide started offering their customers this alternative.

Young Consumers Will Change The Game

The pandemic kicked off a behavioral shift towards online shopping that young customers will drive forward. To appeal to more youthful consumers, online businesses should set out their omnichannel strategies, invest in social media, and prove authenticity.

There is no doubt that Gen Z and Millennials lead the trend when it comes to eCommerce, becoming eager online shoppers. According to Shopify, 67% of them shifted more to eCommerce than older age groups (57% for those 35 - 54, and 41% for 55+). Furthermore, young customers are proficient with social media and technology, so social commerce and other M-commerce trends are worth mentioning.

Gen Z and Millennials are more likely to make online purchases via social media than other age groups. (Source: Shopify)

In 2021, roughly 45% of internet users worldwide turn to social networks at least once per month to look for information about products or services. This figure is higher amongst young age groups. When it comes to brand search, gen Z uses social networks instead of a search engine, and this will soon be the case for younger millennials.

Social networks are on their way to being dominant channels for brand search. (Source: Data Reportal)

The reason behind this is that people no longer trust advertisements; they want authenticity. Alternatively, these consumers seek case studies, advice from friends, families, colleagues, or social proof.

In addition to voice search, image recognition tools on mobile like Pinterest Lens or Google Lens have become more popular. Young women are the most likely to use images as search queries. Hence, these tools open up an exciting opportunity for eCommerce brands, particularly those in categories such as beauty, fashion, home furnishing, and consumer electronics.

Internet users, especially the young generations, are familiar with image recognition tools that search what they see within seconds. (Source: Data Reportal)

Now the question is, which business niches will boom in the post-Covid landscape driven by younger consumers? Let’s take a closer look at the product categories they plan to purchase online before shopping in an offline store when the pandemic ends.

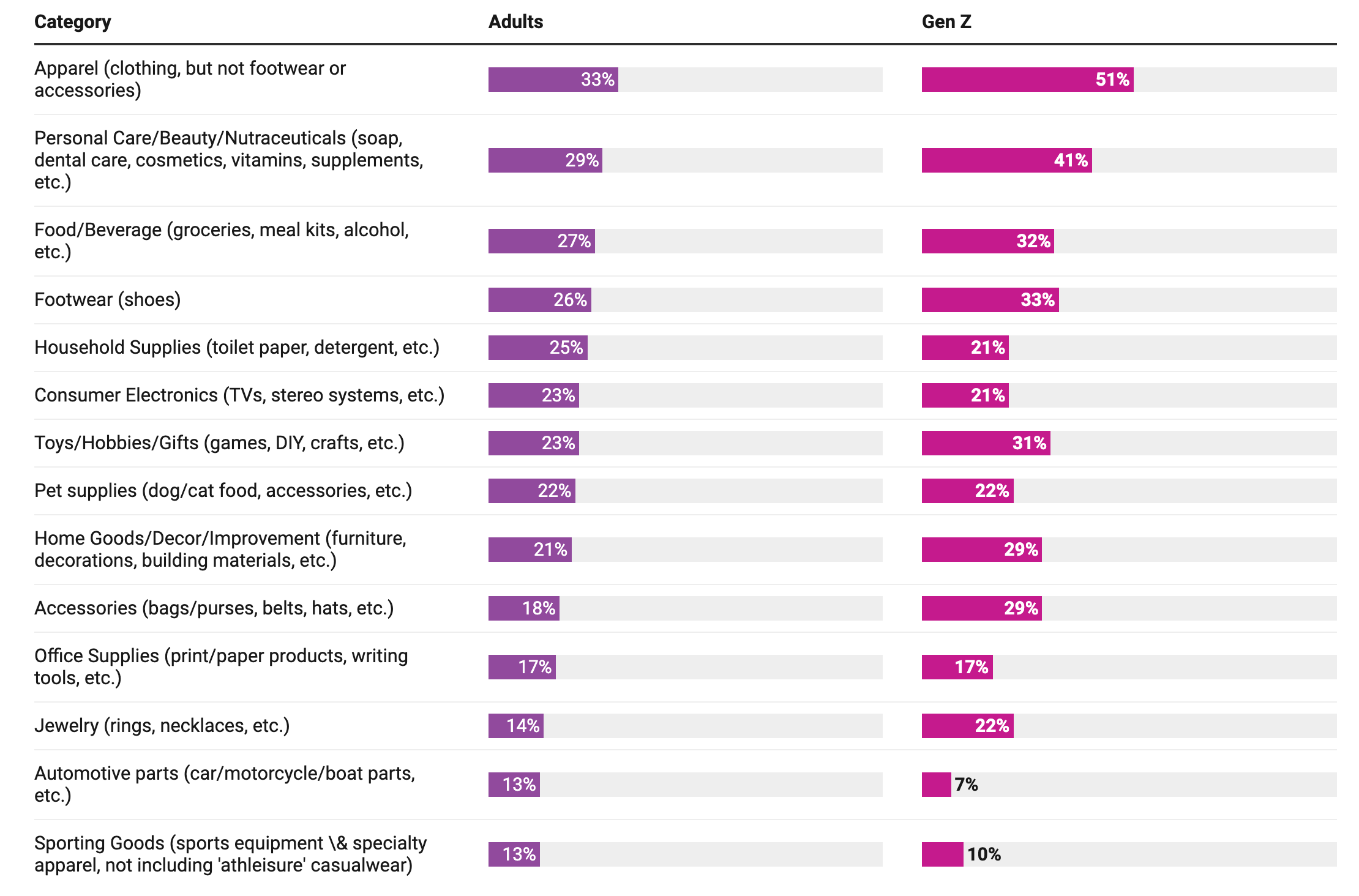

Both adults and gen Z prefer to purchase clothes, personal care products, footwear, and groceries online. (Source: Pitney Bowes BOXpoll)

Their spendings go towards clothing, personal care, beauty, food/beverage, and footwear. Conversely, office supplies, automotive parts, and sporting goods do not seem to stand a good chance in the digital game.

Consumers Look For A Different Experience When Shopping In-Store

Although online shopping will continue to be the main channel by default after the vaccines roll out, 46% of shoppers stated that they want to try and touch items before buying. Meanwhile, 37% said they expect to shop in-store more often as most of them simply want to get out of their houses. Thus, retailers should be aware that consumers might consider in-store shopping a fungible experience - a kind of entertainment called shoppertainment. This is more engaging and could be an alternative to window shopping in the future. You can draw shoppers in-store by offering them interactive activities, and making your store into destinations.

However, CNBC reported that consumers, especially US customers, are still concerned about health risks even after getting vaccinated against COVID-19. As a result, safety will be a factor in your future store design.

To come back stronger and avoid the potential risk of COVID transmission, merchants should:

- Include touchless features in restrooms, for example; contactless faucet handles, motion censored toilets, and lights.

- Add more space for people between merchandise and checkout lanes. Also, big brick-and-mortar stores could install some self-checkout counters to increase safety levels and sales density.

- Offer contactless (cashless) or digital payments, including card payments, bank transfers, e-wallets, mobile payments, and cryptocurrencies.

- Encourage customers to schedule in-store shopping appointments. This will help prevent crowded indoor spaces as well as improve customer service.

Advertising Costs Are Rising

Once governments roll out Coronavirus vaccines, consumer confidence will rise again. According to McKinsey, domestic travel, particularly high-end travel, will be almost back to the level it was at before the pandemic. Consequently, advertisers will need to invest heavily so they can win back customers during the holiday season.

While consumers plan to spend their pandemic savings on touring, the digital competition is heating up. The shift from mass media to online advertising during social distancing has picked up speed. Unfortunately, this has led to a significant increase in ad costs; in other words, it is more pricey to acquire a new consumer in this space. StitcherAds, an agency that works with advertisers on Facebook, Instagram, Pinterest, Snapchat, saw a 47% increase in CPM since March. Worldwide, branded commerce and marketplace apps can now cost companies more than $30 to acquire a new customer.

In 2020, Cost-per-Click (CPC) on Facebook increased by 30%. (Source: Shopify)

Business owners should bring customers intuitive and easy-to-use experiences across channels and devices to get consumers to return to your brand and overcome fierce competition.

- Upgrade the checkout experience: allow customers to save their information for subsequent purchases, eliminate add-to-cart steps by letting customers buy directly from the product pages.

- Bring your brand to life: Livestream shopping events, experiment with AR.

- Prioritize the mobile shopping experience as half of the global online sales happened on mobile devices.

You might also read: Top Tips to Optimize SMB mCommerce Performance.

Final Thoughts

The world is changing faster than ever, and eCommerce is changing with it. We have seen how quickly consumers and merchants adapt to new norms. By sharing our predictions of future eCommerce retail growth, Boost hopes that you will find a way to stand out from the crowded space. Remember to follow us on Facebook, Twitter, and LinkedIn for the latest updates.

See you soon!